Thanks, Rihanna, for being this newsletter’s song title inspiration. More importantly, I choose this song before Rihanna was announced as the next Super Bowl halftime performer, so I definitely deserve some credit in elevating her status. I digress.

While some days we feel dull, the TAM team at TPG is here to help your expertise, contributions, and commitment “shine bright like a diamond.”

Buckle up, readers, we have another big edition coming your way. We continue to have a lot of activity at the state level and some exciting case law to highlight the importance of being consistent in the application of company policy.

FEDERAL UPDATES

New DOL Fact Sheets on Workplace Rights & Maternal Health

In August, the Department of Labor and EEOC presented “Working Mothers: What to Expect from Your Employer When You’re Expecting.” Along with this event, the DOL created new fact sheets on Birth and Bonding and Job-Protected Leave Under the Family and Medical Leave Act.

Gender Dysphoria is Not Excluded from Coverage Under the ADA

Gender dysphoria is not excluded from the broad definition of “disability” under the Americans with Disabilities Act (ADA), a divided panel of the U.S. Court of Appeals for the Fourth Circuit has held. Williams v. Kincaid.

In this case, Williams alleged she was wrongfully incarcerated among the prison’s male population, denied requests for accommodations and medical treatment in relation to gender dysphoria (including hormone therapy she had been receiving for 15 years), searched by male officers, and subjected to misgendering and harassment by prison staff and other inmates.

The Sheriff did not contest that gender dysphoria meets the definition of “disability” under the ADA but sought dismissal of the claim on the grounds that “gender identity disorders not resulting from physical impairments” are specifically excluded by the ADA.

The Fourth Circuit held that gender dysphoria is not a “gender identity disorder,” as that term is used in the ADA. The court explained that when the ADA was enacted in 1990, the term “gender identity” focused on transgender status only and did not include gender dysphoria, which causes “clinically significant distress” and other disabling symptoms. According to the court, the “gender identity disorder” language in the ADA was based on outdated guidance that treated being transgender as a “disorder” in and of itself, whereas modern medicine recognizes that some, but not all, individuals who are transgender will experience gender dysphoria.

The court also held that Williams’ claim did not fit the ADA exclusion because she sufficiently pled her gender dysphoria required hormone therapy, a physical treatment she received for 15 years, and that she suffered physical distress during her incarceration when it was not provided. The court reached these decisions in part based on the 2008 amendments to the ADA and case law that direct courts to broadly construe coverage under the ADA and to construe the ADA’s exclusions narrowly. Ultimately, the court concluded that Congress did not intend to exclude transgender people who suffer from gender dysphoria from the protections of the ADA.

While the Fourth Circuit is the first federal appellate court to consider this issue, the topic has been hotly contested in multiple district courts across the country with mixed results.

The Williams decision is controlling in the Fourth Circuit, which covers Maryland, North Carolina, South Carolina, Virginia, and West Virginia. However, employers across the country should take note of the decision and understand that the reasoning could be adopted in their jurisdictions.

As always, employers should be deliberate and careful to ensure that transgender and gender non-binary staff are treated in a respectful manner and that situations that may lead to harassment and discrimination are avoided. Employers should understand when a gender transition may be necessary and consider how to work with employees to create a successful plan.

FMLA FAQ

Let’s revisit one of the few employer friendly aspects of FMLA. If an employee needs intermittent or reduced schedule leave that is foreseeable based on planned medical treatment, for themselves or a covered family member, due to a serious health condition, or if the employer agrees to permit intermittent or reduced schedule leave for the birth of a child or for placement of a child for adoption or foster care, the employer may require the employee to transfer temporarily, during the period the intermittent or reduced schedule leave required, to an available alternative position for which the employee is qualified and which better accommodates recurring periods of leave than does the employee’s regular position.

While most requests for intermittent leave are unpredictable in nature, employers should be aware, when those leave events are known, there are options to transfer an employee.

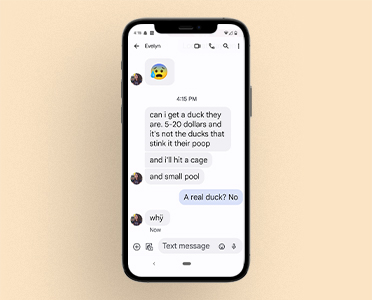

And, while not an FMLA FAQ, shown here at left is a typical FAQ from my 12-year-old daughter, which delayed the completion of this newsletterfor roughly 30 minutes. I don’t recommend phones.

CASE LAW

Consistent Policy Enforcement

For those of you who don’t know me, I live in Omaha, NE, so this case caught my interest. I can also tell you that our family is a big proponent of public transportation and we regularly take Omaha city buses. We may or may not bring cocktails on those bus rides, but that’s not important. However, I was disappointed to read about a former employee’s experience with the company.

John Gruttemeyer claimed his former employer, the Transit Authority of the City of Omaha (Metro), discriminated against him based on his disability when they terminated him in 2016. A jury found in Gruttemeyer’s favor under the Americans with Disabilities Act (ADA) and awarded damages.

A little backstory: Gruttemeyer began working for Metro in 2011 as a full-time bus operator and transferred to a position as a bus fueler and washer in May 2015. He was terminated in July 2016. Gruttemeyer subsequently filed suit alleging that Metro terminated his employment because of his disability – bipolar disorder, anxiety disorder, and depression.

Let’s talk about Metro’s reason for termination, the infamous violations of policy. First, during an incident in February 2016, Gruttemeyer and another employee’s contentious relationship culminated in a heated argument. According to the other employee, Gruttemeyer physically threatened him; Gruttemeyer said they only exchanged words and video footage of the incident confirmed no physical contact. Gruttemeyer was suspended without pay for 106 days, during which time no one contacted him for a statement about the incident. When he refused to sign a “last chance agreement,” which would have allowed him to return to work with certain conditions and penalties, he was terminated. Metro asserts Gruttemeyer’s participation in the incident with another employee was a policy violation and that he was also dishonest at his pretermination hearing regarding the altercation – another violation of policy.

However, Gruttemeyer presented evidence that other Metro employees without disabilities engaged in threatening behavior toward co-workers that also violated Metro policies, but they were not terminated. Additionally, the jury heard evidence that a Metro bus driver and president of the Union spread rumors on the job about Gruttemeyer’s mental health, calling him “nuts,” “crazy,” and “unstable.”

As a result, the jury returned a verdict in Gruttemeyer’s favor on his disability discrimination claim. The jury awarded damages of $114,540 in lost wages and benefits and $25,000 in other damages. The EE’s attorneys were awarded $103k in damages for a total payout of $242,540.

What’s the lesson? Glad you asked. Under the ADA, employers may not “discriminate against a qualified individual on the basis of disability.” And unfortunately, in this case, the evidence supports that Gruttemeyer’s disability was a motivating factor in Metro terminating him.

A violation of a company policy is a legitimate, non-discriminatory rationale for terminating an employee. However, the court determined there was evidence that Metro treated the EE differently than co-workers who had committed similar acts but had no record of disability.

Employers do not need to lower performance or behavioral standards as an accommodation and violations to those policies should be addressed, whether the employee is disabled or not. But, if you only address violations made by disabled employees, you are likely to find yourself in the same situation

Importance of Managers Enforcing Call-Out Procedures

This case involves an employee who was terminated after missing three consecutive shifts without calling in. Seems pretty straightforward, right? Spoiler alert: No.

Under the Family and Medical Leave Act, an employer can insist that employees comply with the company’s “usual and customary” absentee notice procedures. Often those call-out procedures are part of written leave and attendance policies. But if managers don’t require EEs to follow those procedures, the employer will likely lose their ability to enforce those rules.

This company had written attendance and leave policies. Additionally, the policies stipulated that employees notify their group leader via a call-in line at least 30 minutes before their shift begins if they would be late or absent. If an employee missed three consecutive shifts without calling in, the employer would consider the employee to have abandoned his job and would terminate.

However, the plaintiff-employee claimed that through his dealings with the employer, the company’s “usual and customary” notice procedures for leaves of absence expanded beyond its written policy. Specifically, the company had previously accepted his FMLA absences reported via Facebook Messenger, which is how he reported the absences that lead to his termination.

Unfortunately, HR was out of the loop on the Facebook Messenger communications between the plaintiff and his manager and terminated his employment.

So, naturally, the plaintiff sued for FMLA interference and retaliation.

But did Facebook Messenger become a “usual and customary” call-out method? Earlier this month, the Fourth Circuit Court of Appeals agreed the employee had done enough to comply with the employer’s leave notice requirements even though he didn’t follow the rules on paper.

Employer takeaways – we’ve talked about this before. If you have a call-out policy, it should be written, communicated to employees and managers, and followed to the letter. Those policies should outline exactly how an employee should report an absence – must they speak to a live person, can they leave a voicemail, is text acceptable, what detail should they provide, how far in advance of the shift should the absence be reported, etc.

If your policies prove ineffective or outdated, update your policy accordingly and check in with your managers to ensure they are following the proper protocols as well.

UPCOMING EVENTS

TPG will be sending you another educational webinar on the latest with Paid Leave Oregon as rules continue to be finalized. Watch for it in your inboxes in Q4!

STATE UPDATES

CALIFORNIA

COVID-19 Supplemental Paid Sick Leave Expiration

This is the second time in 2022 I have used this exact subject line with “expiration” struck through. But, here we are. So, in “California doing California things” news, and just when you thought COVID-19 Supplemental Paid Sick Leave (SPSL) was about to come to an end, Governor Newsom signed an extension on September 29, pushing the expiration date of September 30 to December 31, 2022. However, the law makes two employer-friendly changes and enacts a relief grant for qualified small businesses to recover expenses related to providing SPSL. So, what do you need to know?

Although AB 152 will require employers with more than 25 employees to provide SPSL for an additional three months, it will not entitle employees to a new bucket of leave. Nor does it change the qualifying reasons for which employees may use SPSL.

Thus, employers should continue to implement and follow the leave requirements set forth in the original law. For a summary of California’s SPSL requirements, an FAQ can be found here. As a reminder, full-time employees are entitled to a maximum of 80 hours of SPSL, which is divvied into two “buckets” composed of up to 40 hours of leave each for different purposes with separate requirements.

Employers must also keep in mind there are a few local jurisdictions in California with their own SPSL ordinances that are tied to their respective COVID-19 emergency declaration period. If you are in any of these jurisdictions, you may count leave provided under one of these local ordinances toward your SPSL obligation under AB 152 so long as the leave was provided for the same reasons and compensates the employee in an amount equal to or greater than what is required under AB 152.

California Family Rights Act Bereavement Coverage

On September 29, 2022, California Governor Gavin Newsom signed Assembly Bill (AB) 1949, which amends the California Family Rights Act (CFRA) to require covered employers to provide eligible employees with five days of bereavement leave. AB 1949 applies to employers with five or more employees nationwide.

Under the bill, employees who have been employed at least 30 days before the leave may take five days of bereavement leave for the death of a family member. A family member is defined as including: spouse, domestic partner, child, parent, parent-in-law, sibling, grandparent, or grandchild.

Employers are permitted to request documentation of the death of the family member, which can include a death certificate, a published obituary, or a written verification of death, burial, or memorial services from a mortuary, funeral home, burial society, crematorium, religious institution, or government agency.

AB 1949 takes effect on January 1, 2023.

California Family Rights Act – Designated Person

On September 29, 2022, California’s governor signed Assembly Bill (AB) 1041, which, beginning January 1, 2023, expands the definition of a “family member” under the California Family Rights Act (CFRA) and California’s Healthy Workplaces Healthy Families Act (HWHFA) to include a “designated person.” Under both the amended CFRA and HWHFA, employees will be able to identify a designated person for whom they want to use leave when they request unpaid (CFRA) or paid (HWHFA) leave. Further, under both amended laws, employers will be able to limit an employee to one designated person per 12-month period.

Under CFRA, a designated person will mean “any individual related by blood or whose association with the employee is the equivalent of a family relationship.” Under the HWHFA, however, a designated person is “a person identified by the employee at the time the employee requests paid sick days” – the individual need not be related by blood to the employee, and their association need not be the equivalent of a family relationship.

CONNECTICUT

Protections for Victims of Family Violence

Effective October 1, 2022, employers with three or more employees must post information concerning domestic violence and available resources, prohibit discrimination against a victim of family violence, and provide reasonable accommodation to victims of family violence.

Additionally, under the amendment, an employer cannot deny an employee a reasonable leave of absence in order to:

- Seek attention for injuries caused by domestic violence, including for a child who is a victim of domestic violence;

- Obtain services including safety planning as a result of domestic violence;

- Obtain psychological counseling related to an incident(s) of domestic violence, including for a child who is a victim of domestic violence;

- Take other actions to increase safety from future incidents of domestic violence, including temporary or permanent relocation; or

- Obtain legal services, assist in the prosecution of the offense, or otherwise participate in legal proceedings in relation to the incident or incidents of domestic violence.

ILLINOIS

Unpaid Bereavement Leave

Beginning January 1, 2023, employers will be required to provide expanded unpaid bereavement leave to eligible Illinois employees under the Family Bereavement Leave Act (“FBLA”). The FBLA amended the Child Bereavement Leave Act (“CBLA”) by expanding the availability of unpaid bereavement leave to cover additional family members and reasons for the leave.

The eligibility requirements for the FBLA mirror those for the Family and Medical Leave Act (FMLA). Accordingly, an employee is eligible to take leave under the FBLA if he or she has worked for a covered employer for at least 1,250 hours within the last 12 months and works at a location where the company has 50 or more employees within a 75-mile radius.

Eligible employees are entitled to a maximum of 10 workdays of unpaid leave following the death of a covered family member or a covered pregnancy, or adoption-related event. However, if an employee experiences the death of more than one covered family member in a 12-month period, the employee is entitled to take up to six weeks of bereavement leave during the 12-month period.

Under the FBLA, an employee may now take bereavement leave for the following “covered family members”:

- Child

- Stepchild

- Spouse

- Domestic partner

- Sibling

- Parent or step-parent

- Mother-in-law or father-in-law

- Grandchild

- Grandparent

Employees may use family bereavement leave to:

- Attend the funeral or alternative to a funeral of a covered family member;

- Make arrangements necessitated by the death of the covered family member;

- Grieve the death of the covered family member; or

- Be absent from work due to (i) a miscarriage: (ii) adoption disruption (including, for example, where a birth parent chooses to parent their child in lieu of proceeding with an adoption plan); (iii) a failed surrogacy agreement; (iv) an unsuccessful reproduction procedure; (v) a diagnosis that negatively impacts pregnancy or fertility; or (vi) a stillbirth.

The employee must complete bereavement leave within sixty (60) days from the date that the employee receives notice of the death or the occurrence of a covered event.

NEW HAMPSHIRE

Contract for Paid Family Leave Approved

One year after the New Hampshire Legislature added a paid family and medical leave program to the budget, the state has found a partner to launch the plans.

Officials have selected MetLife, to set up and administer the new plans. The program is set to launch in January.

The program uses a voluntary, opt-in structure.

Under the contract, MetLife will receive the money to set up a paid leave program that automatically covers all of the state’s 10,000 employees. That program will serve as a base risk pool to allow the insurer to create plans to provide paid family leave insurance to private businesses and employees.

The benefit will pay 60% of employee wages for up to six weeks. It will cover events including the birth of a child, serious health conditions of the employee or a family member, adopting or foster parenting a new child, and foreign deployment in the armed services.

In the coming months, MetLife is also tasked with developing plans for employees in the private sector. Under the state’s program, companies can choose to participate, and those that do will get 50 percent of their costs reimbursed in the form of a tax credit against their business enterprise taxes.

The plans will differ based on whether the employers are large, consisting of 50 employees or more, or small.

Large employers will have the ability to customize how the plans are paid for and what benefits they offer through direct contracts with MetLife. They can adjust the length of coverage – up to 12 weeks – and the percentage of wages that are offered to employees on leave. And they can determine whether the premium cost will be shared with the employee, paid for by the company, or paid for entirely by the employee.

Smaller companies will pay directly into the premium stabilization trust fund.

Meanwhile, employees whose workplaces do not participate in the new program – or self-employed workers – will be able to sign up individually, and also pay a premium into the fund. Those premiums are capped at $5 per week.

NEW MEXICO

Paid Sick Leave

A new law took effect on July 1 that requires New Mexico employers to provide paid sick leave to employees. The New Mexico Healthy Workplaces Act applies to all employers with any number of full- or part-time employees in the state.

The Act requires that employers provide all employees with paid sick leave, either as an annual lump sum of at least 64 hours or via accrual at a rate of at least one hour of paid sick leave for every 30 hours worked.

Employees may use paid sick leave for themselves or a member of their family. Permissible uses of sick leave include:

- Care for the employee’s or their family member’s mental or physical illness, injury, or health condition;

- Preventative medical care for the employee or their family member;

- Meetings at the employee’s child’s school or place of care related to the child’s health or disability; and

- Absences necessary due to domestic abuse, sexual assault, or stalking suffered by the employee or their family member to obtain medical or psychological treatment, relocate, or participate in legal proceedings.

Accrued, unused paid sick leave is not forfeited annually, but rather carries over into the next year. However, employers may limit employees to redeeming, at a minimum, 64 hours of paid sick leave annually.

The state has published a guide which can be accessed here.

NEW YORK

COVID-19 Vaccination Leave Extension

In March 2021, New York enacted a law requiring employers to provide employees with sufficient paid time off to obtain COVID-19 vaccinations. Each employee is entitled to receive up to four hours of paid time off per COVID-19 vaccine injection. The law was set to expire on December 31, 2022. The amendment extends the leave provisions to December 31, 2023.

OREGON

Paid Leave Oregon

Paid Leave Oregon is quickly becoming the “star” of our newsletter. And this “star” is kind of demanding. Expect a number of updates as we around out 2022 and through 2023.

Employee Notice

One “diamond” the state decided to throw the employer’s way is in relation to employee notice.

Under the law, an employer may require an employee to give written notice at least 30 days before commencing a period of leave and may also require the employee to include in the notice an explanation of the need for the leave. The new rules state employers may require the written notice to include:

- the employee’s first and last name;

- the type of leave;

- an explanation of the need for leave; and

- the anticipated timing and duration of leave.

An employee is only required to provide this notice once, regardless of whether the leave is intermittent or continuous. Employees may provide the notice via handwritten or typed documents, email, or text messages, as long as the method of delivery follows the employer’s policies.

Employers that require written notice must make the requirement known in its policies and procedures, a copy of which must be given to new employees upon hire, and each time the policy or procedure changes. Additionally, the employer must include in its policies and procedures a description of the penalties the state may impose for not following the employer’s notice procedures. An employer must provide the notice in the language that the employer typically uses to communicate with the employee.

When an employee applies for benefits, the state will notify the employer that the individual has done so. If the employee did not properly notify the employer, it may report that information to the state within 10 days. The state may reduce an employee’s first weekly benefit amount by 25% if it finds the employee did not provide proper notice. After an employee’s claim has been approved, the state will notify the employer of the approved dates.

We recommend taking advantage of this employer-friendly provision and make written notice, at least 30 days in advance, part of your policies and procedures. Will the state effectively execute the deduction of benefits if the EE fails to follow the proper notice procedure? Well, that remains to be seen, but no matter what type of leave your EE is taking, it’s always important to clearly communicate and consistently enforce those notice requirements.

Employer Notice

The Oregon Employment Department is putting final touches on its Paid Leave Oregon model notice poster, which employers will be required to post at worksites and deliver to remote employees. The poster is expected to be available on the Paid Leave Oregon website in mid-October 2022!

Equivalent Plan Detail

The Oregon Employment Department is now accepting equivalent plan applications. An equivalent plan provides paid leave benefits that are equal to or greater than those provided by Paid Leave Oregon. Employers with approved equivalent plans, and employees working for an equivalent-plan employer, do not have to pay contributions to Paid Leave Oregon. If you already offer paid leave to your employees or are thinking about doing so, you can apply to offer an equivalent plan.

The State has an equivalent plan webpage with videos. They also offer a checklist for employers to see if current company paid leave plan would qualify.

Here are three detailed questions about equivalent plans:

- When can employers apply for an equivalent plan?

Employers can apply for an equivalent plan starting September 6, 2022, through Frances Online. The non-refundable fees for equivalent plans are $250.

- Once employers have an equivalent plan approved by Paid Leave Oregon, will they have to reapply?

Employers must reapply for approval of their plans annually for the first three years. After three years, employers will no longer have to re-apply for approval, and their equivalent plans will remain in place until withdrawn or ended.

- What happens if the application for an equivalent plan is denied?

If the application is denied, the employer remains covered by the state Paid Leave program, and the employer and its employees must pay contributions as required.

Frances Online is Now Available

Oregon employers can now set up their Frances Online accounts, which is a site they will need to utilize for important tasks such as filing payroll taxes and applying for Oregon Paid Leave Equivalent Plans. For help on getting started with Frances Online, you can visit Oregon’s Frances Online Info Page.

WASHINGTON

Final Rule on Paid Leave and Child Loss

As we reported in Q2, Washington has amended its rules regarding paid family and medical leave benefits. Under the law, employers must provide benefits for the death of a child and the postnatal period after childbirth.

Under the final rule, an employee may use paid leave benefits during the seven calendar days following the death of the employee’s child, if the death occurs either during the first 12 months after the child’s birth or during the first 12 months after placement of the child with the employee. The same amount of leave is provided for the death of an employee’s child where the employee would have qualified for medical leave under the law for the birth of the child.

WASHINGTON, D.C.

The District of Columbia has permanently expanded benefits available under Universal Paid Leave. Of note, the waiting period has been removed for claims filed after July 25, 2022, and effective October 1, 2022, the amount of available leave has increased.

| Type of Leave | Amount Under Current Law | Amount Under Amended Law |

| Parental | 8 weeks | 12 weeks |

| Family | 6 weeks | 12 weeks |

| Medical | 6 weeks | 12 weeks |

| Pre-Natal | 2 weeks | 2 weeks |

HAVE QUESTIONS FOR OUR TOTAL ABSENCE MANAGEMENT TEAM?

CHECK OUT OUR BLOG