“In the Pacific Northwest we have unemployment at less than 5% and that is heating up the competition in the job marketplace.”

In this video and article below we review recent studies on how employers are dealing with recruiting and retaining our modern day cross-generational talent pool, and dealing with the greater pressure on HR to provide data.

As presented by Gary Alton, Managing Partner of the Employee Benefits division at The Partners Group, and Nicole Pond, Managing Consultant and Retirement Plans Partner at The Partners Group.

Attracting and retaining quality employees is becoming a hotter and hotter subject in the marketplace that is loaded with challenges. Here’s a couple of interesting ads that we pulled out of the archives.

This is actually an ad from the 1950s about recommending soda pop for your kids. The question is, “How soon is too soon?” The times have definitely changed.

Things have changed a bit since this cigarette ad was published: “More doctors smoke Camel cigarettes than any other cigarette” in the marketplace!…

Things have changed a bit since this cigarette ad was published: “More doctors smoke Camel cigarettes than any other cigarette” in the marketplace!…

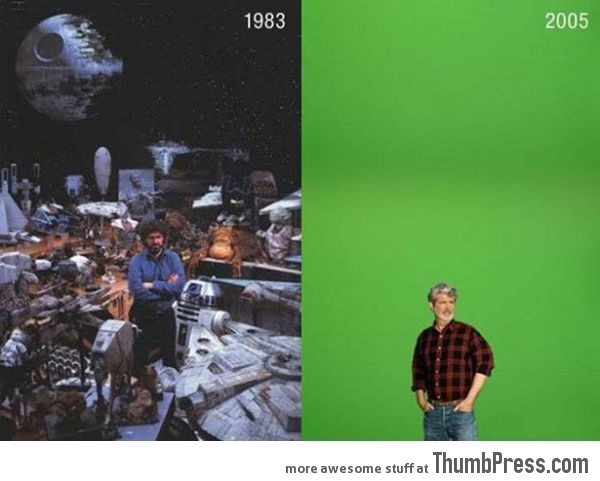

More recently, we have George Lucas, 1983 to 2005 with his Green screen…

The above ads are examples of how the world has changed. We’re going to explore this more with regards to demographics and the workforce, as well as some of the things we’re seeing out there today.

What we’re seeing in the marketplace regarding recruiting and retaining employees:

- Stepped up competition for talent

A recent study put out by SHRM in March of 2016 addresses how employers can deal with this issue. One of the things they’re recommending is creating that strong employer brand.

- Build a strong employer brand

It’s important to recognize your employees are part of your brand, and the employees you’re trying to attract and retain.

- Greater pressure on HR to provide data for making important decisions

There is a growing importance of big data, presenting human resource practitioners with an opportunity to better understand cost drivers and develop long term strategies.

How are we using data to justify key expenses?

We found some interesting statistics in a recent MetLife study in which 2600+ employers participated in ranking the level of importance of their benefit objectives. Now it’s probably not surprising that the top five areas included retaining employees, controlling costs, increasing employee productivity, increasing employee satisfaction, and increasing employee loyalty. However it was surprising how big the percentages were. Also, four of the five top objectives conflict with controlling plan costs. It’s not always true that we need to add more employer paid benefits in order to make employees more satisfied, more loyal, and more productive.

MetLife’s 14th annual U.S. Employee Benefit Trends Study

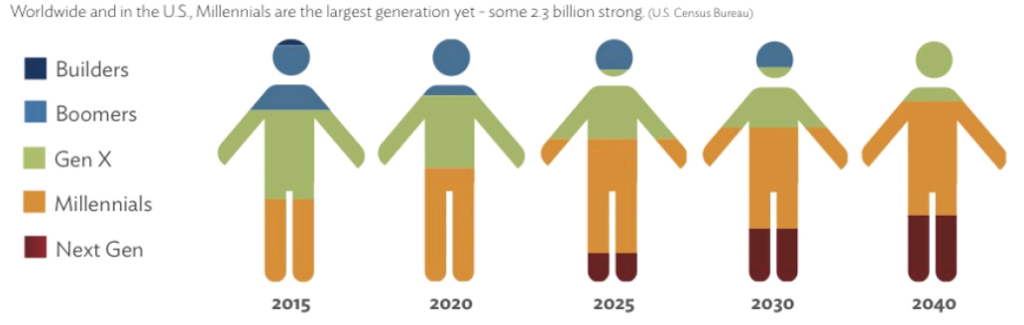

Changing demographics we’re seeing in the workforce today

By 2020 Millennials will actually make up half of the work force in the U.S. There was a great example put out recently by the MIT Age Lab to address this communication issue. It demonstrates the cross-generational interpretation of one question…

When we say “we need to get this project done”:

- Ages between 65 – 70 hear “urgent and immediate action”.

- Ages between 52 – 57 hear “it’s an order”.

- Ages between 36 – 51 or generation X, hear “it’s an observation”.

- Millennials, between the ages of 22 – 34 hear “call for collaboration”.

From a leadership perspective, we need to consider there are four different interpretations from that one statement, and we need to understand how to communicate across these generations. This is one of the key issues our employer customers are dealing with when it comes to communicating employee benefits, communicating retirement, or just communicating across these generational groups in general.

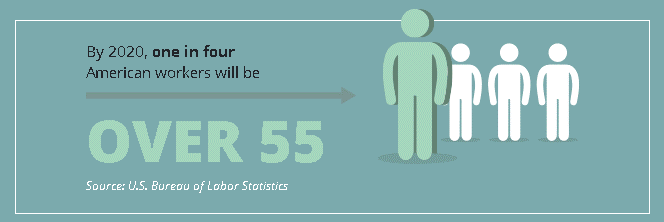

Additionally by 2020 one in four employees will be over the age of 55. This means we’re going to start seeing a transition of knowledge. We’re currently not doing a good job of transitioning that knowledge base.

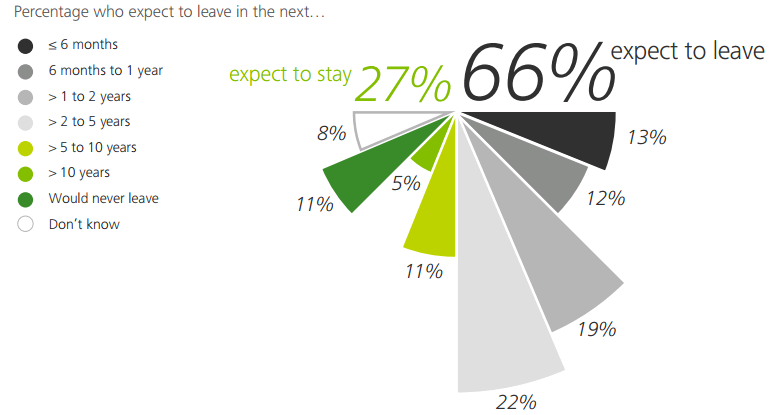

Below are survey results measuring Millennial’s expectations on their length of employment, finding 25% expect to leave their employer in less than a year. That is a huge portion of Millennials who are thinking of leaving their position. Furthermore, one of the biggest things Millennials are stating is that they’re feeling a lack of opportunity when it comes to leadership and expanding in their career.

One foot out the door…

2016 DeLoitte Millennial Survey

Employers need to look at how to retain these key Millennial employees, and fulfilling their need of wanting to grow and further themselves in a career with leadership opportunities. This data tells us it’s important to work on creating mentorship programs and to start transitioning that knowledge from those who are retiring to our Millennial workforce.

The data below measures the values of Millennials for long‑term business success. 26% value job satisfaction, loyalty and fair treatment. 25% value ethics, trust, integrity and honesty, and 19% value customer care and focus.

The values that support long-term business success are people treatment, ethics, and customer focus…

2016 DeLoitte Millennial Survey

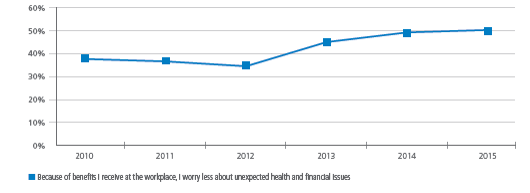

Employees who believe workplace benefits ease their health and financial worries

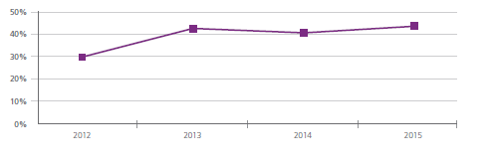

According to the data below, in 2010 almost 40% believed employer sponsored benefits eased their health and financial worries. In 2015 that number increased by 10%, but what about that other 50%? Below we can see only 42% of employees feel in control of their finances, and we need to look at what the other 50% are thinking about.

MetLife’s 14th annual U.S. Employee Benefit Trends Study

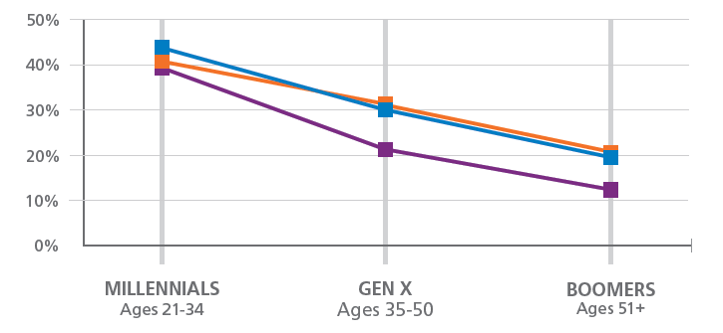

The chart illustrates the viewpoints measured across the generations showing baby boomers are comfortable where they’re at and they don’t need employer assistance. However as we look at Generation X and especially the Millennials, we see they want a coach and someone to guide them or help them better understand their options.

Employees who feel in control of their finances

Generational view of employees’ financial concerns and attitudes

The Employee Benefits Division of The Partners Group serves the employee benefit needs of over 500 West Coast employers, with offices in Portland, Lake Oswego, and Bend, OR; Bellevue, WA; and Bozeman MT. Our benefits consulting team specializes in providing a highly-consultative approach coupled with problem-solving wellness analytics, to help employers reduce healthcare costs, improve employee health, and create long-term health plan stability.

We focused on employee benefits in this article, however The Partners Group works through four different divisions all coordinated together, with services also including wealth management, investment planning for individuals, commercial and individual insurance, and we have business consulting which is more for project based work.

Securities and advisory services offered through Geneos Wealth Management, Inc. Member FINRA/SIPC. Advisory services offered through TPG Financial Advisors, LLC. a Registered Investment Advisory firm.